Turkey stationery market

Turkey stationery market

In this article, we present the details of the market research conducted during the distributor search process in Turkey for DRK, a Dutch manufacturer of PVC film for the stationery sector, in 2017.

Distributor search and local communication

DRK has exported to Turkey for about 25 years and has around 20 loyal customers. However, they needed our consulting services to find an effective distributor throughout Turkey. When we contacted distributor candidates, we saw that many spoke fluent English but preferred communication in Turkish. This shows the importance of using the local language in many countries. During our search, we reached out to about 70 importers, manufacturers, and associations.

These operated in various stationery categories, such as notebooks, files, tapes, paper, and metal mechanisms. The firms included large, medium, and small companies, many of which were family-owned businesses.

The stationery sector in Turkey

One of the biggest challenges facing the stationery market in Turkey is high competition and price pressure. Intense competition in both the domestic and international markets has led to falling prices and narrowing profit margins. Additionally, fluctuations in raw material costs and production expenses for stationery products complicate cost control and pricing strategies.

Regulation of hazardous materials in stationery products

The use of certain banned raw materials in stationery products is regulated due to health and environmental risks. Chlorinated compounds, such as PVC (polyvinyl chloride), are among the restricted materials for such products. Furthermore, materials containing harmful heavy metals like lead, cadmium, and mercury are banned or restricted.

Import dependency and market impact

Turkey’s dependency on imports for some stationery products has also contributed to rising costs, particularly due to fluctuations in exchange rates. The rise of digital technologies and the digital transformation in education have reduced the demand for traditional stationery products, affecting their market share.

Turkey is a significant player in the global stationery product export market, ranking 11th worldwide.

Turkey has particularly developed its stationery exports toward the European and Middle Eastern markets. Moreover, the stationery sector holds high potential within the national economy. It ranks as one of the most advantageous countries in the Eurasian region regarding quality, equipment, and logistics. Additionally, with a young student population of 12-15 million, Turkey leads many European countries.

The size of the stationery sector in Turkey is estimated to be around $3.5-4 billion.

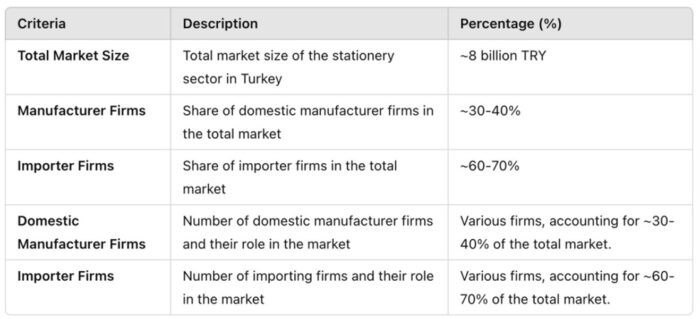

The sector comprises approximately 350 suppliers, manufacturers, and wholesalers, and 25,000 retail companies. According to TUKID (Association of Stationery Product Importers, Exporters, and Wholesalers), there are about 30,000 companies in the sector, including retailers. There are approximately 120 domestic manufacturers and around 10 foreign manufacturers operating in the sector. Additionally, there are about 200 importers in the industry. It can be said that around 80% of the approximately 500 brands in the market are foreign.

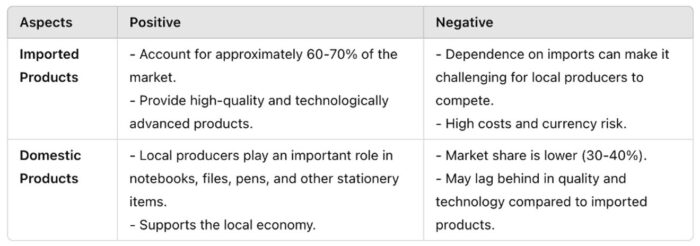

The distribution of imported and domestic products in the Turkish stationery market shows a certain imbalance. Imported products make up approximately 60-70% of the market.

Imports have been a common source, especially for high-quality and technologically advanced stationery products, with Turkey sourcing these products from regions such as Europe, Asia, and North America. Domestic production covers about 30-40% of the market. Domestic manufacturers in Turkey play a significant role in notebooks, files, pens, and other stationery products. However, domestic products generally have a lower market share compared to imported products. The stationery products imported into Turkey predominantly come from China, Germany, Italy, South Korea, Austria, the USA, Canada, France, and Japan.

Contact us

If you would like more information about office supplies, PVC, foil, plastics, the market situation in Turkey, or finding suppliers and distributors in these and related sectors, please contact us. We can arrange a call with our consultant, who managed the distributor search project in Turkey for this company from the Netherlands.

Are you also looking for distributors?

Are you also looking for distributors or sales partners? Read more about our consultantcy for distributor and agent search.