Exploring opportunities in the Turkish market

Exploring opportunities in the Turkish market

RuR Engineers, an Indian plastic injection molding company, sought market research to explore potential opportunities for their products, specifically in the glassware industry. In 2018, CuB Consultants conducted a market analysis of Turkey’s glassware sector, focusing on plastic injection molding applications for products such as kitchen and tableware.

Turkey: A strategic commercial hub

Turkey presents a relatively safer environment for commercial activities compared to neighboring countries. Its robust market is fueled by a growing population and strategic geographical position, acting as a bridge between the Middle East and Europe. This, combined with its political stability and the turbulence in nearby regions, makes Turkey an attractive market. For Asian countries, Turkey is ideally positioned to serve both European and Middle Eastern markets efficiently.

Opportunities in Turkey’s plastics industry

Turkey’s local plastic industry faces limitations due to a shortage of domestic raw material production, creating opportunities for foreign products to fill the gap. Import prices for plastic products are significantly higher than export prices, highlighting the demand for external suppliers.

In terms of engineering and design, the Turkish plastics industry is still developing, which presents opportunities for innovative foreign products. However, the market is highly competitive, with both domestic and international players vying for a share. New entrants must therefore focus on innovation and cost-efficiency to succeed.

The growing kitchen glassware market

In Turkey, plastic products, particularly kitchen glassware, hold a significant market share. This sector benefits from a well-established distribution network through wholesalers, retailers, and increasingly through online platforms. These products reach even the most remote areas of the country, highlighting the extensive distribution channels available.

Navigating international competition

Turkey’s domestic market is flooded with both locally produced items and imports, particularly from China. As a result, companies entering the Turkish market must be competitive in both quality and pricing to stand out.

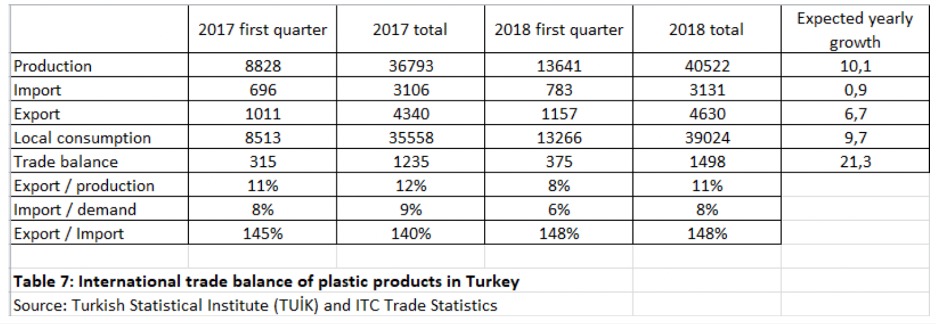

The plastics industry plays a crucial role in Turkey's economy, which ranked as the 17th largest in the world with a growth rate of 6.1% in 2017. In 2016, the industry’s annual growth rate averaged 15%, with production valued at $35 billion. The sector exports $5 billion annually while importing $3.1 billion worth of products.

Turkey’s plastics industry in numbers

The industry employs approximately 250,000 people across 6,500 active companies. Of these, 90% are small or medium-sized enterprises, with only 10 companies capable of large-scale production. The sector’s distribution is as follows: 15% in packaging, 11% in construction, 10% in textiles, 10% in household goods, 9% in automotive, 15% in technical components, and 10% in other applications.

Contact us

If you're looking for reliable overseas suppliers or need a quick market analysis in any country, including Turkey, contact us today for assistance.

Are you seeking new suppliers abroad?

Discover more about our services for sourcing overseas. and how we can assist your business.